Credit cards are excellent financial tools, provided you use them intelligently. They bring convenience, safety, and an entire gamut of benefits that can supercharge your financial well-being. To make the most of their complete potential, it is worth seeking out and implementing intelligent tips. In this article, we shall explore good credit card tips that really work.

Choose the Right Credit Card

Choosing a card to match your purchasing style is essential. Cards reward in different methods too, i.e., cash back, air miles, or reductions in certain shops. In the event of frequent trips out, e.g., an airline mileage card is ideal for you. Websites like NerdWallet have ranked the best credit cards in 2025, whereby you can make a comparison.

Pay Your Card Bill in Full Every Month

Having a credit card balance translates into paying costly interest fees. By paying the balance in full at the end of every month, you sidestep these fees and earn a good credit score. Not only does it save you money, but it also makes you look credit-worthy.

Use Sign-Up Bonuses

Most sign-up reward credit cards offer sign-up bonuses, which give you points or cash back after you have spent a specific amount of money during the first few months. Some cards, for example, will give you a $200 bonus after you spend $500 in the first three months. Buying expensive items with these cards can help you meet the said spending level without spending too much.

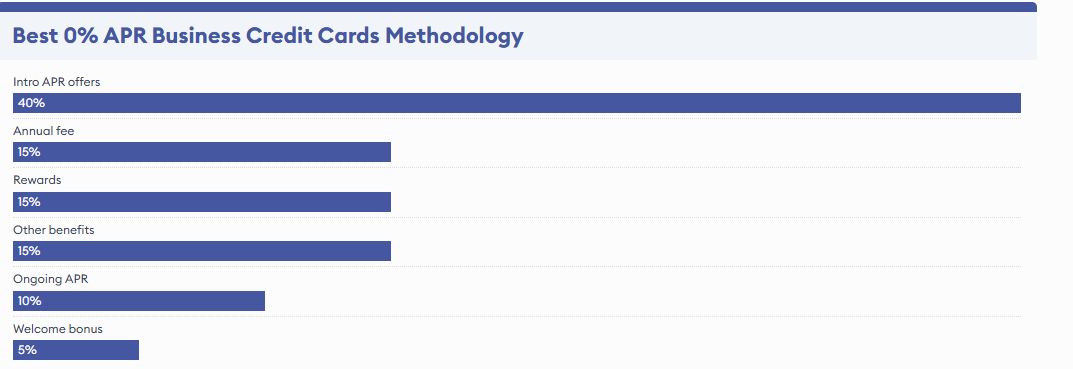

Take Advantage of 0% Introductory APR Deals

Others have a 0% intro Annual Percentage Rate (APR) on purchases or balance transfers for a limited time. This comes in handy if you will be making a large purchase or consolidating debt. The U.S. Bank Visa Platinum Card, for instance, features a lengthy intro offer with 0% APR to pay balances over time interest-free.

Stack Rewards and Benefits

Stacking several credit card rewards and benefits can contribute to your savings. For instance, getting cash back on grocery shopping with a card and additionally receiving store-specific coupons can lead to significant savings. Some cards provide purchase protection, extended warranty, or trip cancellation/interruption insurance, which adds value.

Watch and Guard Your Credit

Monitoring your credit card statements periodically detects unauthorized charges earlier. Being aware of your credit score and how it changes makes for smarter personal finance decisions. Having credit monitoring services or apps at your disposal can help with stay on top of your credit health.

Avoid Unnecessary Charges

No credit card charges, such as annual charges, late payment charges, or foreign transaction charges. Fee-free annual or foreign transaction fee-free cards are inexpensive, especially when you travel overseas often. For example, the Capital One Platinum Secured Credit Card incurs no annual or unexpected fees and hence is an affordable choice.

Use Credit Cards for Routine Spending

By paying regular expenses like utilities, groceries, and gasoline on your credit card, you receive rewards within a snap. Ensure you have funds to settle the charges in full at the end of the month so that you do not incur interest charges. This converts regular expenditure into a reward.

Automate Payments

To never be late, set up automatic minimum payments. Then, you will never be late, and your credit score will be good. You can always pay more than the minimum yourself to pay off your balance sooner.

Use Balance Transfers with Caution

While balance transfers to a lower-interest card can be a money-saver, look at the transfer fee and the period of the promotional rate. Balance whether the savings are worth the fee before acting. As an illustration, there are credit cards with longer balance transfer times, but carefully examine the terms ahead of time.

Investigate the 15/3 Credit Card Payment Trick

The 15/3 trick is making two payments every month, one 15 days prior to your statement date and the other three days prior. The idea is to lower your reported balance, thus possibly optimizing your credit utilization. The success of the trick depends, and it is important to know how this can fit within your overall budget.

Be Aware of Deceptive Hacks

Not all hacks on credit cards are beneficial. For instance, purchasing gift cards solely to have rewards or to open and shut accounts constantly with the intention of receiving a welcome bonus will pay out in fines or decrease the credit score at some point in time. An investigation and careful consideration of these actions’ future consequences is worthwhile.

Keep Up-to-Date on Card Changes

Credit card rewards and terms can be altered. Monitor your credit card company’s notices to stay informed about changes that will affect fees or rewards. United Airlines, for example, recently altered rewards and fees on its credit cards, which impacted cardholders.

Take Advantage of Credit Card Perks

In addition to rewards, most credit cards offer other perks like travel insurance, purchase protection, or extended warranties. Familiarize yourself with these perks to get the most out of what your card can offer. Certain cards, for instance, offer invitations to exclusive events or concierge services.

Consider Credit Cards for Building Credit

If you are a credit builder or new to credit, consider secured credit cards or credit-builder cards. While these might require you to make a deposit, they are typically solid choices to help you build a positive credit history if you use them wisely. For example, the Petal® 1 Visa® Credit Card offers cash-back rewards and no security deposit.

Conclusion

Credit cards, when used intelligently, can be incredibly useful, from rewards to ease of cash flow. Credit card success is all about having the right card to match your spending, paying off balances in full each month, and optimizing benefits and rewards. Being smart, well-educated, and attuned to the insidious “hacks,” you will be able to maximize your financial wellness and achieve maximum credit card utilization.