When discussing personal retirement savings, it is not often you read about a new retirement account. New strategies or tactics are common, but a new account is unique.

While HSAs are not new to the market (they have been around since 2004), their application to retirement healthcare is. Let us show you why HSAs are equally helpful for healthcare and retirement savings.

What Is an HSA?

A Health Savings Account is a tax-advantaged account specifically created for people with high-deductible health plans (HDHPs). The primary purpose of an HSA is to save on medical expenses, but the benefits do not stop there. It is the only retirement account offering triple tax benefits, making it one of the most powerful tools for future saving.

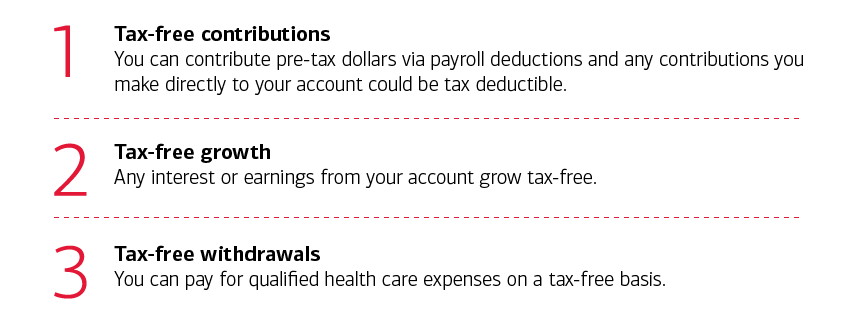

Triple Tax Benefits of an HSA

Tax Deduction on Contributions: Contributions to an HSA are tax-deductible, just like in a traditional 401(k) or IRA. This means you can reduce your taxable income for the year by the sum of contributions to the account, thus potentially lowering your overall tax liability. For 2024, individuals can contribute up to $3,850 to an HSA, while families can contribute up to $7,750.

Tax-Free Growth: Any investment growth within your HSA is tax-free. In other words, you pay no taxes on the interest or investment returns you earn on your contributions, which allows money to grow exponentially over time.

Tax-Free Withdrawals: The cherry on top? If you use the money in your HSA for qualified medical expenses, those withdrawals are tax-free. This can be very helpful as a way to pay for things like prescriptions, visits to physicians or other healthcare providers, dental work, and even some of these over-the-counter medications.

But few people know this: After age 65, you can withdraw HSA funds for any reason, exactly as you can from a regular IRA, and the withdrawals will be tax-free so long as they are applied to medical expenses.

How to Make the Most of Your HSA in Retirement

To truly take advantage of your HSA, you need to focus on long-term growth. Here are a few ways you can use the power of this account:

Contribute the Maximum Possible: Even at age 55, every year, you have the legal right to contribute the maximum allowable amount and up to $1,000 more as a “catch-up contribution” if you are 55 or older.

Invest Your Money: Most HSA administrators permit you to invest your HSA dollars in stocks, bonds, or mutual funds. That means your money will appreciate over time just as it would if you were investing in an IRA or 401(k). The more diversified your portfolio, the more money you will earn, which can be used for healthcare costs (or general retirement costs) later on.

Preserve the receipts of medical expenditures: If you are not utilizing your HSA money, then preserve all the receipts of medical expenditures. You can reimburse those expenses even after years, provided you withdraw the money tax-free. The money in your HSA balance will also act as another source of income in old age.

Put Off Medical Expense Withdrawals: If you can, avoid using your HSA for medical expenses until retirement. That will let your account continue growing tax-free, and you can use it as a retirement savings tool instead. You can use your HSA for any purpose without penalty when you are 65 or older, which is a significant supplement to your retirement income.

Things to Consider Before Opening an HSA

Before you start to understand the benefits of an HSA, make sure it fits your overall financial situation:

Eligibility: You need to have a high-deductible health plan to be eligible for an HSA. Check to see if your current health plan meets the requirements.

Contribution Limits: In 2024, the contribution limits are $3,850 if contributing individually and $7,750 if contributing as a family. These figures vary with the level of inflation each year.

Medical Needs: The beauty of an HSA is its potential to be a fabulous retirement tool, but you must make sure you are using it for its purpose-medical expenses. In cases where you can not put much into an HSA or otherwise incur large medical costs, you could focus on other retirement accounts.

Why the HSA is Revolutionizing Retirement

The HSA’s tax-free advantages make it the best option for retirement savings compared to other conventional retirement accounts. However, how does it compare to other savings options?

The New Stealth IRA

An HSA, or Health Savings Account, is a personal savings account for health expenses. It is not a health plan but can be used in conjunction with HSA-eligible health plans, like HDHPs, to save tax-free dollars on health expenses.

HSAs allow for tax-deductible contributions, tax-free interest, and tax-free withdrawals (for medical expenses). In 2019, individuals can contribute up to $3,500 in tax-free savings, and families can contribute $7,000.

HSAs were intended for health savings, but as part of their tax structure, they have one extra perk: retirement savings. After the age of 65, you can use your HSA funds for anything, just like a 401(k) or IRA. In that sense, they mimic the IRS tax structure of a 401(k) or IRA.

HSAs also have no mandatory distributions, so you can let any HSA investments grow as you see fit into your 70s, 80s, and 90s. It is nice to have control!

No matter the intended use of an HSA, it creates additional tax-free retirement savings opportunities. Add the added flexibility of saving for healthcare and retirement at the same time to create an incredible tax-advantaged opportunity.

Combining a 401(k) or IRA with an HSA

The more money you have for retirement, the better. By combining the tax value of a 401(k), IRA, and HAS, you get to keep more of your money (from the IRS) and save for retirement.

Did you know that in retirement, a couple can expect to spend $275,000 on health costs? This is on top of Medicare coverage. The only way to pay 100% tax on these expenses is through your HSA.

HSA savings pave the way to cover health costs for today and in retirement. Combined with a 401(k) or IRA, you can maximize your tax-free retirement savings potential and keep more of your hard-earned money. You can review your eligibility and open an HSA here.

Conclusion

Traditional retirement accounts such as 401(k) and IRAs tend to overshadow one’s mind. Still, the HSA is actually an amazing tool that can help save for retirement and simultaneously reduce taxes paid.

It holds triple tax benefits and can be used both for healthcare and retirement expenses, which can be a dual advantage, helping you cover the future costs incurred in medical conditions and supplement retirement income. If you are eligible for an HSA, do not overlook this powerful retirement account—it could be the hidden gem in your retirement savings strategy.