When starting a new year, one can always reflect on setting and making goals for financially meaningful reasons throughout the next one. Personal finance management is a way to save money and make smart choices that protect wealth-building activities, keep you out of debt, and set your path to long-term prosperity.

Whether you want to pay off debt, increase your savings, or invest in the future, the new year is a great opportunity to reset your financial habits and take control of your money.

Here is a roadmap to help you maximize your finances

Reflect on the Past Year’s Financial Health

Before setting new goals, take some time to reflect on your finances in the past months. Review your income and expense structure, including major decisions you made on money matters. Did you stick to your budget? Were there unexpected expenses that threw off your plans? The better you understand where you are, the better decisions you can make.

Track Your Spending: Use apps or spreadsheets to look at where your money went. Did you spend more on dining out or subscriptions than expected? Were there areas in which you saved more than anticipated? These could give you a clue as to where you should make changes.

Check Your Credit Score: Your credit score is an important indicator of your financial health. You can request a free credit report to ensure no errors or fraudulent activities are affecting your score. A good credit score will help you get lower interest rates on loans and credit cards.

Set Clear Financial Goals for New year

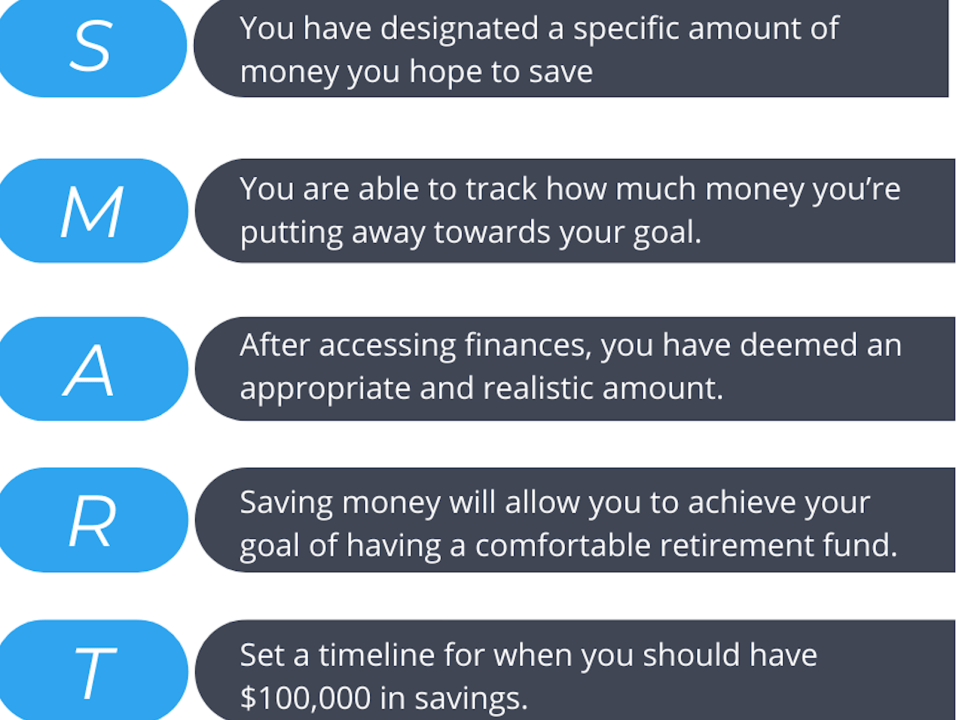

Having reflected on your past year, now set clear financial goals for this coming year. One must set realistic and achievable goals to stay motivated and on the right track. Some common goals pertaining to finance include the following:

Debt Reduction: If you are carrying high-interest debt, such as credit card balances, make it a priority to pay it off. Start with the smallest balance (the “snowball method”) or focus on the highest interest rate (the “avalanche method”).

Emergency or Build Fund: Many financial experts advise people to maintain three to six months’ livelihood expenses in some liquid form of savings to cover unpredicted events and emergencies. If you either don’t have it or it’s not satisfactory, then try putting aside some % of your income every month till that mark is reached.

Retirement Savings: If you still need to contribute to retirement accounts like a 401(k) or an IRA, consider setting up automatic contributions. Even a small percentage of your income can add up significantly over time.

Invest More: The new year is a perfect time to examine your portfolio in depth, whether it involves stocks, real estate, or other forms of investment. Research and diversify to strengthen those investments.

Focus on Your Credit Score

A strong credit score is vital for securing favorable terms on loans, mortgages, and credit cards. If your credit score is lower than you would like, take steps to improve,Start by:

- Paying bills on time

- Reducing credit card balances to below 30% of your credit limit

- Disputing any errors on your credit report

Practice Financial Discipline

Lastly, financial success never happens overnight; it requires discipline and consistency. Throughout coming year, stay committed to your financial goals. Regularly check in on your progress, adjust your budget, and keep your spending in check.

Remember to reward yourself every time you hit milestones, whether big or small, such as when you pay off a debt or reach a savings goal. Small wins along the way will keep you moving in the right direction toward your long-term financial future.

Earn More

While the concept of earning more money may sound infantile or outside your realm of control, there are some things you can do to supplement your income. Some basic ideas include:

- a part-time job

- become a mystery shopper

- do some freelance work

- maximize contributions to your 401k if the company you work for offers a matching option

- personal finance

Spend Less

By making simple cutbacks, you can spend less without sacrificing your standard of living. Spending less on frivolous expenses leaves more money for you to use toward your financial goals. Here are some tricks to help you save:

- Do not carry a balance on your credit card to save interest charges

- make meals to eat at home instead of eating out

- purchase clothes at a thrift store or consignment shop

- use coupons or watch for sales

Sell Stuff

You may not be willing to sell your plasma or downsize your home, but there are more than likely still items around your house that could be sold for some extra cash.

- old gold and silver

- used household items and electronics can be sold in a garage sale or on Craigslist

- rent a room in your home to somebody or get a roommate

- sell handmade items at craft fairs or on a website like Etsy

- Cash back bonuses

Credit cards can be detrimental to personal finances if they are not used wisely. Carrying a balance on a credit card is like throwing money away on interest. You spend more to purchase items when you pay interest on credit cards.

However, if you are disciplined enough and monitor your spending well, you can use the credit card offers to your advantage. When cards offer a cashback bonus award, you can actually make a little extra money by using your credit card to pay for items you buy anyway. Gas purchases, groceries, and even utilities have to be paid each month, so why not use your credit card and earn cash back instead of paying interest? The key is always to pay what is owed on the card in full each month and only to use a card that does not charge fees for usage.

Pay Off Debt

Similarly to paying interest on credit cards, it is silly to pay interest on other loan items if you do not have to. If you are able to pay a little extra on your car payment, student loan, or mortgage, do so. Over time, you can pay off the debt and save interest money. Paying down debt also keeps the debt collection agency at bay and prevents bad debt collection experiences.

Conclusion

The new year is an exciting time to reset your financial strategy and set yourself up for a more prosperous future. Reflecting on the past year, setting specific goals, creating a solid budget, and focusing on investing are all ways you can take charge of your finances. Stay disciplined, track your progress, and celebrate your wins along the way. Here is to a year of financial success!