A personal loan is an efficient financial tool as you can withdraw money for any purpose you like, whether you want to withdraw it for an unexpected expense, to make a major purchase, or even to clear out some old debts. However, just like in every financial matter, there will always be good and bad ones. Here is a proper discussion of the advantages and disadvantages of personal loans.

Advantages of Personal Loans

A personal loan is an effective financial tool; you can access funds for whichever use you have in mind, whether it be for an emergency expense, a big purchase, or even for debt consolidation. However, as with any other financial decision, there are always advantages and disadvantages. Below is a proper discussion of the pros and cons of using personal loans for your benefit.

Pros of Personal Loans

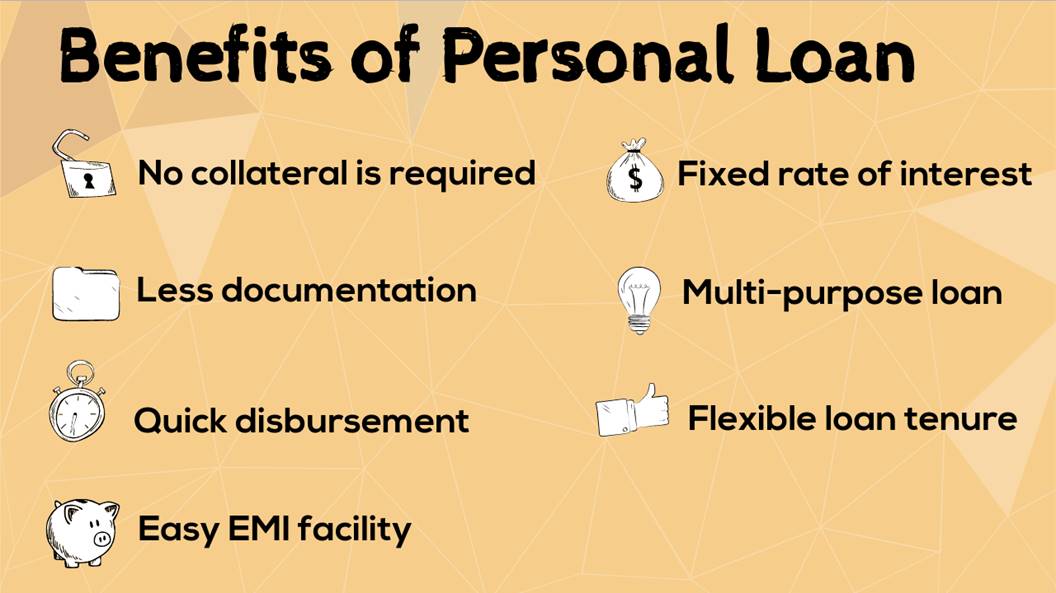

- Easy and Reliable Source of Funds: Personal loans are one of the best options regarding facility speed and reliability. Fund availability usually follows within a few days after approval. This is a convenient option for prompt urgency.

- Flexible Usage: In most loans, usage is defined; for instance, home loans or car loans. However, with a personal loan, it can be utilized for nearly any purpose. From medical bills, education, to traveling, one can even combine credit card debt- all your choice.

- Huge Loan Amounts: In personal loans, you actually get to borrow big amounts. This is really useful for costs or purchases that will cost much, such as those that must be paid at once. For instance, when faced with a medical emergency or wedding costs, the amount you might need can be generated through personal loans while being able to stretch payments over a period of time.

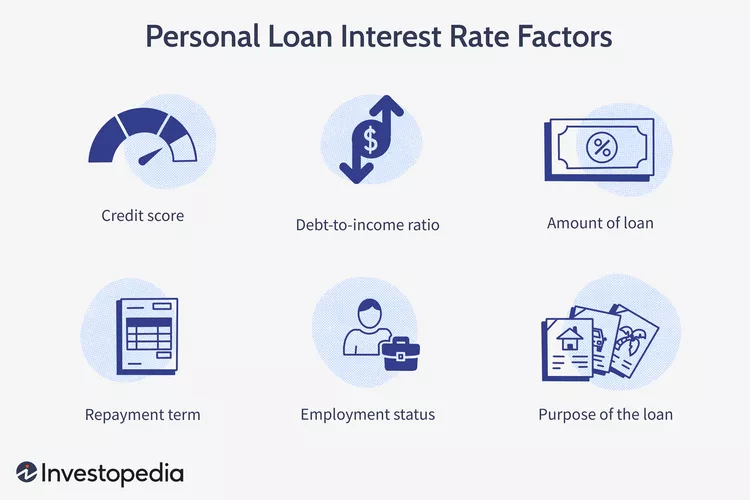

- Competitive Interest Rates: Compared to other loan markets, the personal loan market is quite competitive. Actually, most of the lenders provide competitive interest rates especially for borrowers who have high credit scores. In some cases, it is even possible to bargain for lower rates and pay out less money when servicing the loan.

- No Agents: When taking a personal loan, you always deal directly with the lender. Agents and middlemen are eliminated to make direct communication possible at an almost lower cost.

Disadvantages of Personal Loans

- Long-Term Financial Obligation: Most personal loans carry repayment terms that range from one to seven years. This is a long period of time during which you can space out your repayments, but this also commits you to a long-term financial liability. It is stressful if you miss payments or default.

- Prepayment penalties: Lenders, in some cases, charge penalties for paying off the loan earlier. This might seem beneficial since it would save the money otherwise spent on interest payments on a more extended term. However, one should first read out the terms and conditions before signing the agreement.

- Strict Eligibility Criteria: As personal loans are often unsecured (i.e., they do not require collateral), lenders apply stringent eligibility criteria. A good credit score, stable income, and low debt-to-income ratio are often a must to qualify. For individuals with poor credit, approval might be difficult, or the interest rates might be substantially higher.

- Potential Debt Trap: Personal loans can be beneficial but may eventually put the borrowers into a debt trap. Over-borrowing or ineffective repayment may create instability in the economy.

- Temptation to Borrow Unnecessarily: Personal loans may become easily and readily available for some people. It may, therefore, cause people to borrow more than necessary or finance some non-essential spending. It will lead to unnecessary debt and stress in the finances.

Factors to Consider Before Taking a Personal Loan

- Review Your Current Financial Position: First, evaluate your current financial situation before taking up a personal loan. Make sure you have a steady source of income and can clearly show the plan to pay back to prevent financial stress.

- Compare the Lenders: each lender gives out other interest rates, fees, and terms. Take your time to shop and compare a better deal suited to you.

- Know the loan terms: Carefully read the loan agreement and pay attention to the interest rates, repayment terms, processing fees, late payment penalties, etc.

- Borrowing Loans Wisely: Borrow only what you need and avoid taking a loan for non-essential expenses. Use the funds responsibly so that the loan adds value to your financial situation rather than creating unnecessary burdens.

Final Thoughts

Sometimes, personal loans can be a lifesaver in times of financial need, offering a quick and flexible solution to various monetary challenges. However, that comes with its own set of risks and responsibilities. Careful evaluation of all pros and cons and current financial circumstances will tell you whether a personal loan is the right choice for you.

Remember that taking a loan does not necessarily help you in dealing with current situations but secures your future finances. In case you feel sure about handling repayment and you have gone through all the details of the terms, a personal loan can prove to be an ideal means for attaining financial success.