A private mortgage is a non-traditional financing option, usually provided by individuals or companies rather than a traditional lender. These mortgages are often sought after by people who fail to authorize a traditional mortgage or need short-term financing or a quick influx of cash.

Let us get into what private mortgages are and why you might want to apply for a private mortgage in Canada.

What is a Private Mortgage?

A private mortgage is a short-term loan used to finance real estate. These loans usually last 1 to 3 years. Their main advantage is that they help improve cash flow.

Many private mortgages allow you to pay only the interest, not the principal. This eases cash flow issues in the short term, but you will not lower the debt if you are just paying interest. You need to view a private mortgage as something you are going to pay off, and then you should plan to pay it off.

Why may I want to consider a Private Mortgage?

Private mortgages tend to carry higher interest rates, various lender fees or commissions, shorter terms, and interest-only payment options, which do not decrease the loan principal. Some even stop accepting payments in full and add the accrued interest and fees to the balance when payable.

For expert advice, consult a licensed mortgage broker or agent registered with FSRA. They will assess your situation, explain why you need a private mortgage and work with you to explore all the available financing options. Brokers are legislatively obligated to recommend a solution that fits the needs of the client.

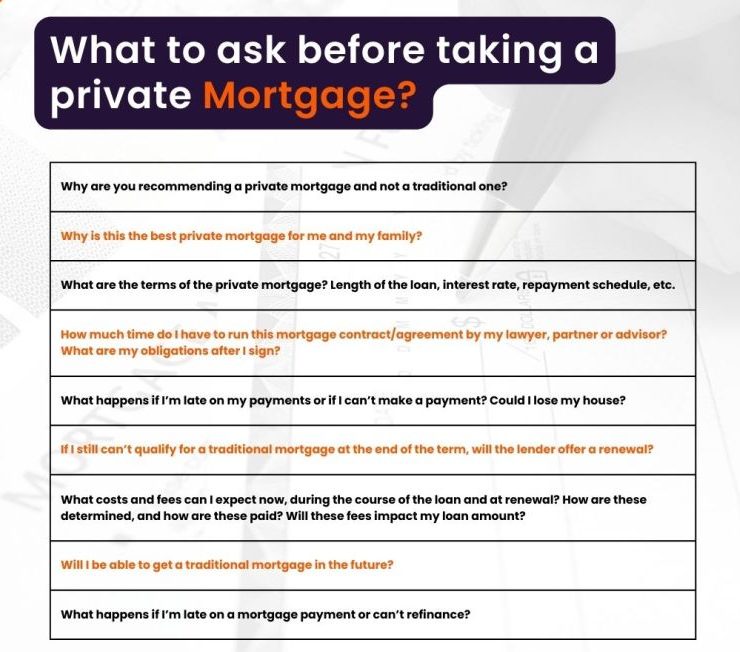

Take the time, ask questions, and make sure you understand fully before making a decision. This can be beneficial if you need better credit due to job loss, illness, or family issues.

Here are some specific reasons a person may choose private mortgages:

- Nonconforming property: You can buy a property that the banks would not finance, such as a motorhome, vacant land, a fixer-upper, or a hobby farm.

- Rapid approval: You really need to get your mortgage approved quickly, and the conventional banks would not meet your timeline.

- Poor credit: If factors beyond your control have marred your credit, private lenders will still likely accept your application if you explain the factors.

- Short-term loan: If you only need money for a short period, private mortgages might be your best option.

- Nonconforming mortgage: If you cannot demonstrate enough income to obtain a conventional mortgage—in retirement or if you are self-employed, for example—a private mortgage may still be possible.

What is it that private lenders take into consideration when approving a mortgage?

When you apply for a private mortgage in Canada, lenders will want to know why you need the money. They are usually willing to authorize reasonable requests. These include reasons for debt consolidation, home renovations, or preventing foreclosure.

In an effort to reduce their exposure, private lenders generally have a maximum loan-to-value (LTV), so they will typically lend at most 75% of the property’s value. In some urban markets, private mortgages can go up to 85% LTV.

Private lenders often like to be in the first position for a first mortgage for protection purposes if there is a foreclosure.

What is to be expected from mortgage rates and fees?

Pay higher rates and fees compared to regular lenders because private lenders are a last resort. But if your private mortgage is only temporary and you can pay it off, it can still help you quite well.

Interest rates for private mortgages are typically between 6% and 18%. This is significantly higher than conventional lenders’ rates, which currently stand at around 3% to 5%. CMI offers private mortgages starting at 5.99% for first mortgages and 7.99% for second mortgages, depending on several factors, including your credit score, the LTV ratio, and property appraisal.

Another factor to consider is the fees associated with private mortgages. Fees are always incurred with a private mortgage, including mortgage brokers, who charge a fee for assisting you. They vary anywhere from 1% to 3%, deducted both by the broker and lender. Be sure to ask about all fees before applying so there are no surprises.

One of the benefits of private mortgages is that many are “interest-only” and fully open. This means you can pay off the loan in full or break the mortgage at any time without penalties, giving flexibility.

Why do I need an exit strategy?

Failure to pay off a private mortgage might leave one in a tight spot as these loans are aimed at providing short-term help. FSRA stresses that private mortgages should not be seen as long-term reliance.

Normally, the period that one has for using a private loan is supposed to service their finances to ensure that they secure usual finance in about a year or two.

Private lenders often lend based on the value of your property rather than your income, so it is possible that you will only pay interest during the term of the loan and not any principal.

Such a setup highlights the importance of having a good exit strategy in order to transition into conventional options for a mortgage. With a strategy, you may avoid facing the negative implications of private mortgage refinancing – one usually with horrible fees or the prospect of being declined.

Private mortgages seem attractive when trying to become a homeowner, but such a move is certainly not a viable long-term solution. A well-informed and strategic approach will always benefit you more in the long run.

Conclusion

Private mortgages may be helpful if planned. The most important thing is to ensure that you have a plan on how to transition back to a traditional lender as soon as it is financially feasible. A mortgage broker can help you find a private mortgage that suits your needs, and by using one, you will set yourself up for long-term success.