Do people actually need a family budget?

Having a fixed and pre-planned amount that can be spent every month on expenses would not only give peace of mind but also help as a powerful tool to predict expenses while saving for the future.

When most people are wary of making up a family budget because it would be a complicated mess of accounting practices and numbers, it, actually, is simply a bit of financial planning where one sits down and figures out how much one has and how much one would need.

Having a family is always a huge responsibility, and numerous things must be taken care of. The safety and security of the family are always top priorities. With a budget, one is free of the worry about being able to pay bills while putting away money for children’s education, medical emergencies, retirement, etc.

In this article, we examine why family budgeting is such an important undertaking and how to implement a plan that will keep everyone satisfied.

Clarity and Control Over Finances

One of the major reasons a family budget is important is that it gives you an idea of where your money is going. With a budget, it is easier to spend too much on important things, and then, at the end of the month, you have little to show for your income. A family budget gives you a clear view of your expenses, income, and savings goals, thus enabling you to make informed decisions about how to allocate your money.

By tracking spending, you will see precisely where your money is going—to bills, groceries, entertainment, or dining out. You will be aware of this and cut back on unnecessary expenses; this way, you will give priority to what truly matters in your family. You will make sure that with a solid plan, you are in control instead of allowing your finances to control you.

Helps to Instill Better Family Financial Habits

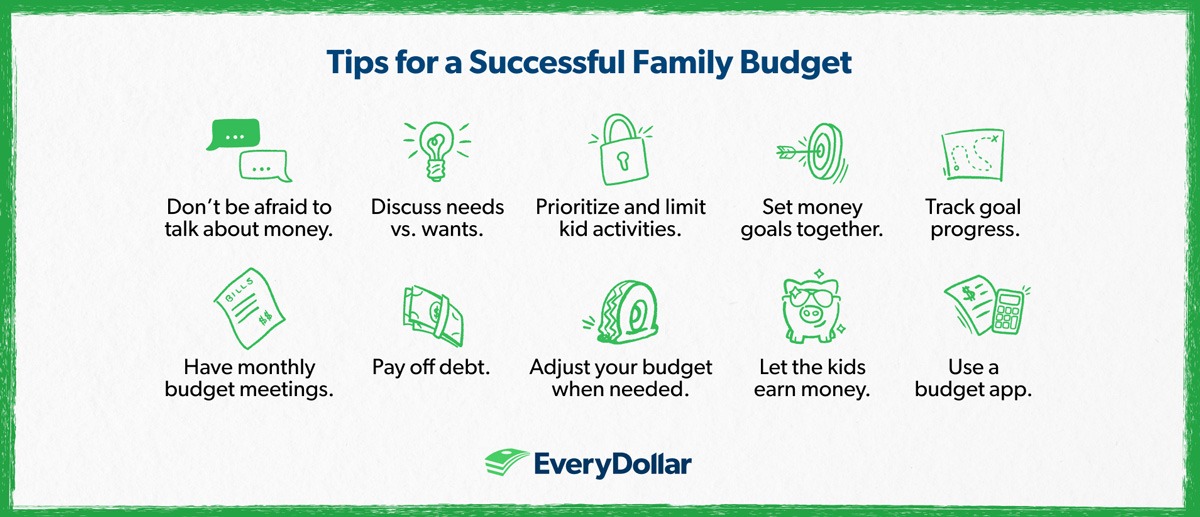

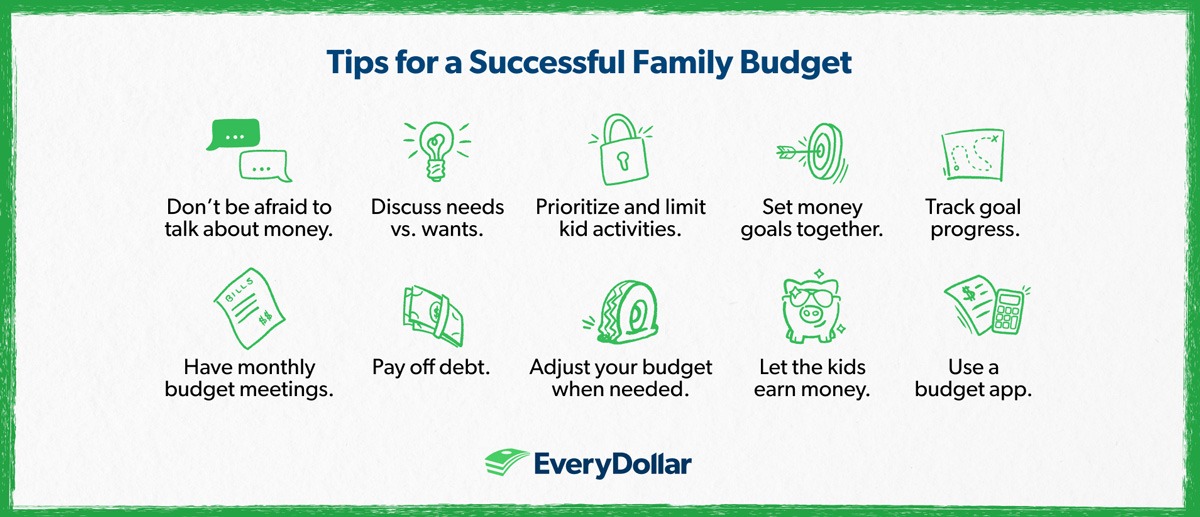

Budgeting is not just about the numbers; it is a way to develop better financial habits as a family. Involving everyone in the household in budgeting encourages teamwork and shared responsibility. This is the best time to teach children the value of money, saving, and living within one’s means.

For instance, let the kids make simple decisions like choosing between store brands and name brands or comparing utility costs across seasons. These little lessons can translate into a lifetime of financially literate adults who value the art of budgeting and saving.

Prevents Unnecessary Debt

Many families fall into debt because of careless spending. Without a budget, one lives from paycheck to paycheck, leaving little room for emergencies or unexpected expenses. When these things aren’t planned for, it is easy to rely on credit cards or loans to cover the gap.

A family budget enables you to plan for inevitable expenses, such as medical bills, car repairs, and home maintenance, so they do not catch you by surprise. You may build up an emergency fund, save money for major purchases, and avoid high-interest credit cards.

Achieving Financial Goals Together

Every family has different goals, be it saving for a vacation, buying a new home, funding education, or building retirement savings. A family budget helps you break these goals down into manageable steps. By allocating a portion of your income toward savings and investments, your goals become more achievable.

For example, you can set aside a certain amount each month toward the cost of a family trip next summer. Whether it is paying down student loans or saving for a down payment on a house, budgeting ensures you take steps toward these long-term goals without sacrificing daily needs.

Reduces Financial Stress and Conflict

Money remains one of the major stressors within families, usually leading to many disagreements and tension. Not having a clear plan about how finances are handled often makes one partner overwhelmed or left out of the money management process. This results in misunderstandings, frustration, and sometimes arguments.

With a family budget in place, everybody is on the same page: you can openly discuss money, prioritize spending, and decide on what is important for the family. With a family budget, the family members feel better about communication concerning finances; hence, stress and conflict over money can be reduced. It also ensures all parties are involved in financial decisions.

Enables You to Plan for the Future

A family budget is not only for tracking where your money is going now but also for planning for the future. From saving for retirement to setting up college funds to buying insurance, a budget enables you to look to the future and make certain that you are prepared for what’s down the road.

A good budget includes not only monthly expenses but also long-term savings and investments. It allows you to plan for your family’s future, ensuring that you have enough resources for your kids’ education, your retirement, and other big milestones.

Flexibility and Adaptability

One of the best things about a family budget is that it is not set in stone. Life is unpredictable, and your financial situation can change with job shifts, moving to a new city, or family circumstances. A well-thought-out budget is flexible and can be tailored to new needs. Your budget can evolve with the family’s changing needs, be it cutting back on certain expenses, reallocating funds, or adjusting savings goals.

Conclusion

A family budget is one of the most effective ways of securing financial peace of mind and making long-term goals. It creates clarity, instills teamwork, prevents debt, and ensures all family members work toward one common future. By making and living within a family budget, you will reduce stress, increase communication, and live a more fulfilling life.

Don’t wait until the bills are mounting up or your savings account is empty. Take control of your finances today and start building a budget that works for your family. The earlier you begin, the sooner you will reap the benefits of living within your means and achieving financial success as a family unit.