Too many teens and adults go through life without ever having learned financial responsibility. This can lead to mountains of credit card debt and long years paying off loans that could have been avoided if they had known how to manage money from an early age.

If you want to prevent this from happening to your children, start teaching them about money early. One way to do this is with their allowance. They will understand that their allowance comes from working hard, along with what it means to save money and how to be responsible for it.

When to Give Your Child an Allowance

The time when your kids get an allowance and what they are rewarded for depends on the parent. A good time to start giving an allowance and teaching your children about money is when they are old enough to count.

Some parents believe allowance should not be combined with household chores, thinking kids should do the chores regardless of getting paid for them. Others like teaching their children that hard work equals allowance (and a paycheck later on).

If you would rather not combine them, have kids do additional chores to get an allowance, like shoveling snow in front of your house. Either way, use allowance to show your child that working hard for your money is important regardless of what occupation they plan to have. All types of professionals work hard for a paycheck, from accountants to street sweepers to plumbers.

It is never too early to start teaching financial skills, and they can make a big difference to your child later on. Start early and teach your kids to count with play money, including dollar bills and loose change.

Get them into the habit of counting the change when you get home from the store. This is great practice for when they grasp money, and you start giving an allowance.

How Allowance Helps Kids Learn About Money

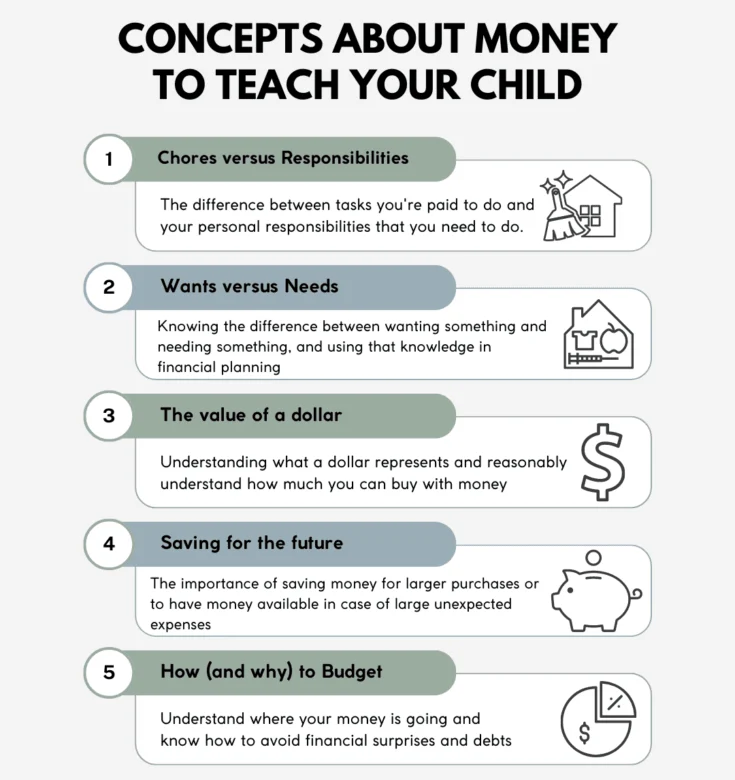

There are a variety of ways in which giving your kids an allowance teaches them about money and financial responsibility. For one thing, they are going to get practice in counting money, which is good for younger children. As they get older, they will understand that the work they do, such as their chores and homework, will be the only way they get the allowance.

Furthermore, your children will start understanding the importance of saving money. If they want an expensive toy, have them save their allowance and buy it themselves.

A good way to get kids thinking about interest rates and debt from a young age is to explain to them that whatever they save towards a particular item, they will contribute the same amount. If they want it right away, reduce their allowance by more than the item would cost overall.

Here is how to use allowance effectively to teach kids the value of money.

Decide the Right Amount and Frequency

Set a regular amount and schedule for giving allowance. Experts recommend $1 per week for every year of age. Thus, a 10-year-old would get $10 a week. This way, the amount increases commensurate with the maturity of their financial understanding.

Discuss the why behind the amount, making it clear what expenses it covers. For example, they might need to budget for school snacks, toys, or small outings. Clarity prevents entitlement and promotes accountability.

Tie Allowance to Responsibilities

Rather than handing money out free, tie the allowance to the work. This teaches children that money is earned, not given. At an age-appropriate level, chores could involve cleaning their room, grocery assistance, or taking care of a family pet, which helps to give a sense of accomplishment.

While paying for everything should be avoided, some chores, such as tidying up, can remain unpaid lessons on the importance of contributing to the household as a team. Paying for all tasks can create an imbalance between paid and unpaid tasks.

Use the Save, Spend, Share Model

Show your child how to split their allowance into three groups:

Save: Save for larger goals, like a new bike.

Spend: Spend money on every day wants, like treats or small toys.

Share: Donate to a cause they care about (e.g., animal shelters or charities).

Offer them three jars or digital alternatives to track these categories visually. Watching the savings accumulate will teach them the importance of patience, and sharing will breed generosity and empathy.

Let Them Make Mistakes

Another temptation is to step in every time your children want to spend their money on unessential items. Avoid this temptation! It is so important for them to realize that overspending or impulse buying mistakes lead to consequences. If they spend all their allowance on candy and cannot afford the toy they had been eyeing, they will indeed learn a valuable lesson in prioritizing needs over wants.

Teach Budgeting Basics

Help your child make a simple budget. Sit down with them and write their source of income (allowance) and suspected expenses. Make them know how to spend wisely by creating limits for all of it. For instance, they can choose to spend only 50% of their allowance and put the remaining in the savings for something big.

Use apps or printable templates that are created for children to make this experience enjoyable and interactive.

Teach about Interest

To encourage saving, give interest to their savings jar. You can put in $1 for every $10 that is saved over a month. This introduces them to compound growth and motivates them to save even more.

As they grow older, you can explain real-world interest and how it works in savings accounts, loans, and investments.

Talk About Needs vs. Wants

Teach the children to differentiate between needs and wants. Use real-life experiences, such as groceries versus toys, to teach them.

When they demand something, you can question them:

- Do you need it or want it?

- Can you afford it now, or should you save for it?

- Will you be happy for a long time with this purchase?

This habit teaches the children mindful spending.

Set Goals Together

Help your child set up savings goals. If it is a new toy, video game, or a family trip to a dream destination, it is easier for them to develop a savings habit by having a tangible reward in mind. Additionally, use a visual tracker, such as a goal chart. It keeps them disciplined and gives them pride in achieving their target.

Set Good Financial Examples

Children learn from what they see. If you implement intelligent money management, they are likely to do the same. Discuss your budgeting decisions, savings goals, or charitable contributions openly. For instance, explain how you save for family vacations or why you compare prices before buying.

Your actions reinforce the lessons you teach them through your allowance.

Periodically Adjust the System as They Grow

As kids grow up, so do their financial needs and responsibilities. From a weekly allowance to a monthly one, they gradually learn to accept banking, credit cards, or, for that matter, investments.

Consider teaching them digital money management in a cashless world using a prepaid card. Apps like Greenlight or GoHenry are great tools for teaching teens to track spending or manage balances responsibly.

The Long-Term Benefits of Allowance

The allowance is a teaching tool that helps kids understand what they need to learn about money in preparation for adulthood. They will be introduced to the concepts of budgeting, delayed gratification, and generosity.

Start low, keep it consistent, and make financial lessons a part of everyday life. Your guidance will help your child grow into a confident, money-savvy adult who understands the value of a dollar.

Conclusion

Allowance is not just pocket money; it can become the gateway to financial literacy. Approach this in a structured manner, and you can turn a simple weekly allowance into lifelong lessons for which your child will thank you.