Bankruptcy is a very overwhelming and complex process; it can also be a breath of fresh air for people who feel drowned by debt. Federal laws have been designed to help people break free from financial burdens and begin anew.

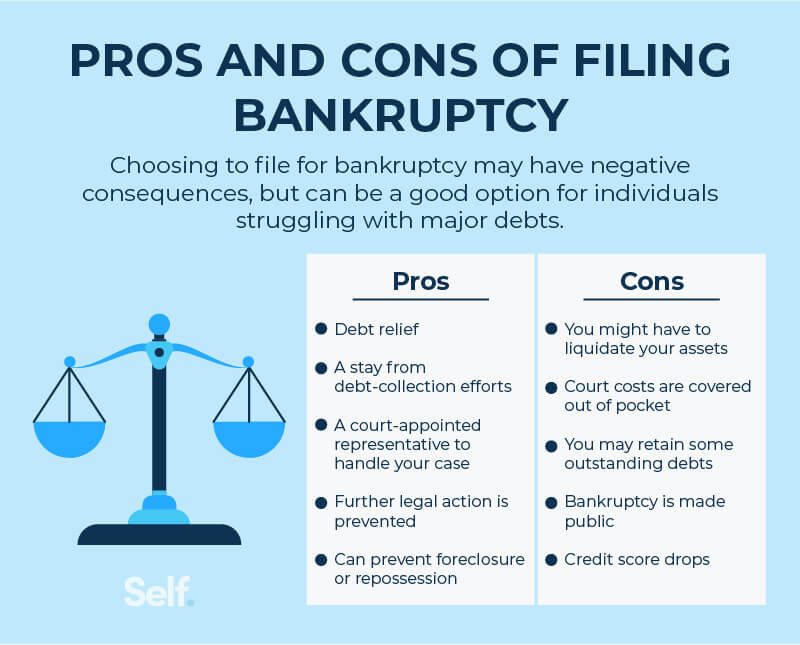

However, before you decide to file for bankruptcy, it is essential to fully understand the process, the advantages, and the potential drawbacks.

In this post, we will walk you through a simple and easy guide to filing for bankruptcy and help you determine if it is the right choice for you.

Deciding Whether Bankruptcy is the Right Choice

Consider All Your Options

Bankruptcy should be the last resort, as it has long-lasting consequences. A bankruptcy filing can remain on your credit report for up to 10 years, and it could make it difficult to obtain credit, secure loans, or even find certain jobs. That said, it can offer a clean slate for individuals who cannot find a way out of their financial struggles.

Before you decide to file, consider other alternatives that may be able to help you manage or eliminate your debts. Here are some options:

- Financial Coaching or Credit Counseling: You can get the services of a professional to walk you through your debt case. A credit counselor will assist you in coming up with a budget, and devising a debt management plan, and can even negotiate with creditors.

- Credit Card Consolidation: This is the process through which multiple credit card balances are combined into one loan with a reduced interest rate that will ensure you can pay your debt faster and at an affordable price.

- Refinancing or Loan Modification: If you have loans that are hard to repay, refinancing or modifying them could reduce your monthly payments or extend the repayment period, which will make it easier to manage your debt.

Know When Bankruptcy is the Right Decision

Although there are other options available, there will be times when bankruptcy may be the last resort. Filing for bankruptcy can also put a halt on the actions of creditors in the process of collection. These actions may include wage garnishment and foreclosure on your property. Consider filing for bankruptcy if any of the following are applicable to you:

- Your wages are being garnished, or your property is being foreclosed.

- You owe back taxes in substantial amounts.

- You are being sued by creditors for unpaid debts.

Hire a Lawyer

The legal process of bankruptcy filing is usually long and tedious; hence, errors can be expensive. To prevent errors that would jeopardize the case, you are advised to hire a competent bankruptcy attorney who will guide you through the complications of the process and ensure all the legal formalities are adhered to.

Why Hire a Lawyer?

A bankruptcy lawyer will help you:

- Choose the right type of bankruptcy for your situation.

- Complete and file the necessary paperwork.

- Represent you in court and communicate with creditors.

While hiring a lawyer comes with fees, it is crucial to remember that having a professional guide can significantly improve your chances of a successful bankruptcy case.

Know the Costs of Filing for Bankruptcy

Declaring bankruptcy is not free and costs money. Overall costs may include court filing fees for the bankruptcy petition and other types of filings, as well as an attorney’s fee, which, in many cases, runs on a flat fee but would depend on the complexity and location of your case.

In addition, you would have to pay for credit counseling courses, which you are mandated to take prior to filing bankruptcy.

Some individuals cannot afford to pay for lawyers. However, there is free or low-fee legal service for those qualified. If you feel the price will be too steep, always ask about possible payment plans or lowered fees.

Understanding the Types of Bankruptcy

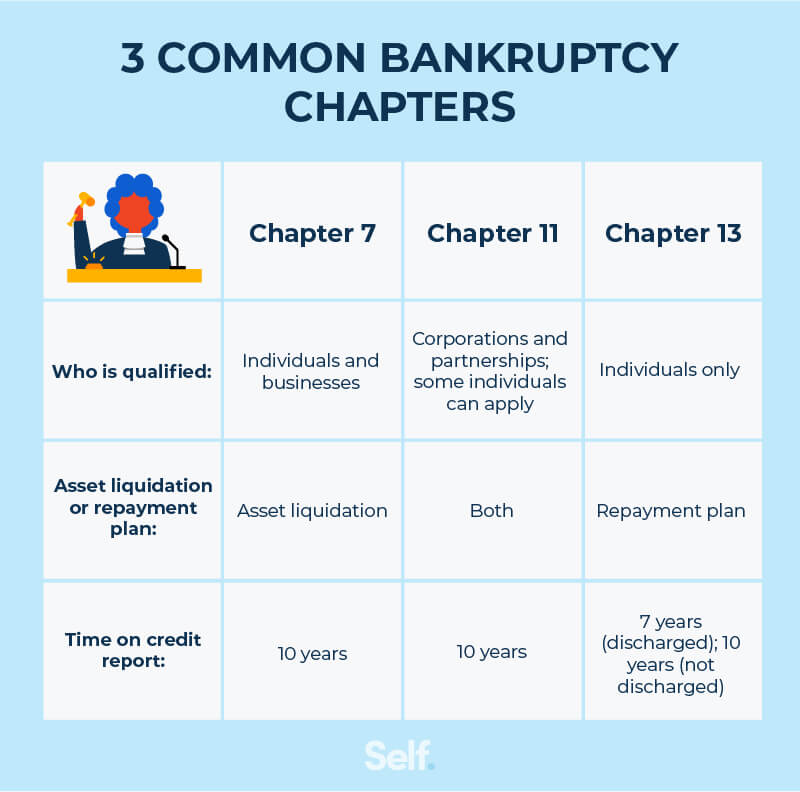

There are several types of bankruptcy filings, but the two most common for individuals are:

Chapter 7 Bankruptcy (Liquidation Bankruptcy)

This is the most common type of bankruptcy and involves liquidating (selling) non-exempt property to pay back your creditors. However, certain assets may be exempt, meaning you can keep them. After your non-exempt property is sold, the remaining unsecured debts, such as credit card balances and medical bills, are usually discharged (forgiven).

Chapter 13 Bankruptcy (Reorganization Bankruptcy)

Unlike liquidation, Chapter 13 bankruptcy enables debtors to maintain their property and work out a suitable payment plan against debts owed. It generally involves making monthly payments, for three or five years, into a plan managed by a trustee, who forwards the money to the creditors. Once you have made payments under the repayment plan, it typically ends with any remaining qualifying debts being discharged.

Initiating the Filing Process

Once you have selected the appropriate form of bankruptcy, your attorney will prepare and file a bankruptcy petition on your behalf. This includes providing an itemized list of your debts, assets, income, and expenses.

Pre-Filing Preparation

Prior to filing, be sure you have done the following:

- Completed Pre-Filing Counseling: Many bankruptcy courts require that you participate in a credit counseling session with an agency authorized by the court before you can file.

- Prepare Your Financial Documents: Be ready to provide proof of income, tax returns, property details, and any other documents requested by your attorney or the court.

The Court Process

Once you have filed your petition, the court will organize a meeting of creditors, more commonly referred to as a 341 meeting, where the bankruptcy trustee will question you about your finances, assets, and debts. You will be sworn in, and your answers will be recorded at this meeting.

It is crucial to meet with your attorney before this meeting to go over your financial situation and ensure you have all the necessary documentation.

What Happens Next?

After the meeting of creditors, your case will proceed to either liquidation (in Chapter 7) or reorganization (in Chapter 13). The court will review your petition, and if everything is in order, you will receive a discharge of your debts.

In Chapter 7, the process usually lasts for four to six months. With Chapter 13, it takes three to five years as you follow the repayment plan.

Conclusion

Bankruptcy does give a new beginning, but knowing the long-run effects is crucial. It is not a magic pill but a well-thought-out and well-planned activity.

However, with the correct guidance from a seasoned attorney, bankruptcy can give you a chance to build your financial future again and gain control of your life.

If you are considering bankruptcy, take the time to weigh your options, consult with a bankruptcy lawyer, and ensure that it is the best choice for your situation.