For any family facing financial distress, deciding which debts to pay first is a constant issue every month. When you have limited income and more debt than your budget can handle, you have to start making hard choices to keep your family afloat. So, how do you decide which debts to pay first and how to pay everything back efficiently?

Understanding Your Debts

Before you choose which debt to pay first, take a very transparent survey of your indebtedness. Start by making a list of all your debts, including:

- Creditor name

- Total amount owed

- Minimum monthly payment

- Interest rate (APR)

- Payment due dates

This overview helps you understand the scope of your debt and identify which debts are the most urgent or costly.

Key Strategies for Debt Prioritization

Several well-known approaches exist to prioritizing debt repayment. Ultimately, the decision will depend on your financial goals, personality, and circumstances.

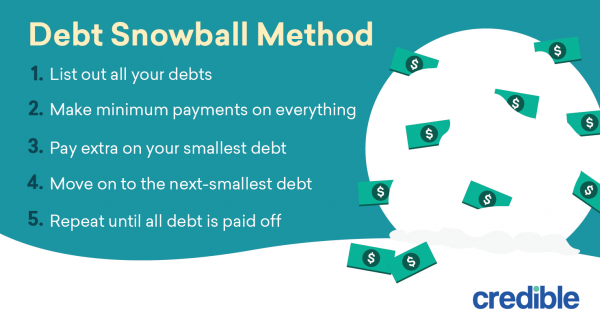

Debt Snowball Method

How it works: Pay off the smallest debts first, not necessarily by interest rate, while paying minimums on other debts. When one of the small debts is satisfied, you will roll that amount you were paying into the next smallest debt.

Why it works:

- Provides rapid wins, picking up enthusiasm and morale.

- It helps create momentum as every single debt is paid off one at a time.

Who it’s suitable for: People who require psychological wins to help them stay motivated on their journey of debt repayment.

The Debt Avalanche Approach

How it works: The debts that carry the highest interest rate are paid first, while the minimum payments on all other debts are made. Once the highest-interest debt is paid off, progress to the next most expensive one.

Why it works:

- Reduces the overall interest paid over time.

- Usually, it results in a faster overall debt pay-off.

Who it’s for: People who are responsible and goal-oriented, looking to save every dollar possible.

Prioritize Based on Risk

Some debts are more dangerous to your wallet’s health if ignored. These must be tackled first:

- High-Interest Debts – Credit cards, payday loans, and personal loans with high-interest rates can quickly spiral out of control due to compounding interest. Addressing these debts first prevents excessive interest costs.

- Secured Debts – Secured debts, such as mortgages or car loans, are tied to assets that can be repossessed if payments are missed. If keeping these assets is essential, prioritize these debts to avoid losing your home or vehicle.

- Debts with Legal Consequences – Unpaid taxes, child support, and other medical debts may lead to lawsuits, wage garnishment, or liens on your properties. To prevent future problems, all these should be settled instantly.

Considerations When Prioritizing

- Your Financial Goals – If you are primarily motivated to save and have financial goals, the debts with the highest interest rates should be your priority. If you need emotional impetus, you may want to start with smaller debts for faster wins.

- Your Cash Flow – Focus on the account’s positive cash flow. If a monthly debt repayment is too onerous, consider refinancing, consolidating, or negotiating a better payment.

- Urgent Debt – Some debts demand attention, like those with deadlines or severe consequences.

How to Get Back on Your Feet and Start Paying Off Debt

- Create a Budget: A transparent budget helps you ensure that you have enough money for your debt repayment and other necessary expenses. Here’s a good benchmark: the 50/30/20 rule

- 50% towards needs

- 30% towards desires

- 20% towards savings and debt repayment

- Create an Emergency Fund

Before aggressively tackling debt, set aside at least $500–$1,000 for emergencies. This will help you avoid depending on credit cards or loans during unexpected expenses.

- Negotiate a Better Deal

Reach out to your creditors to try to reduce interest rates, give you more time to pay off, or even settle the debt. Many companies are amenable to working with you if you are proactive about it.

- Debt Consolidation

Combining several debts into one loan with a lower interest rate or easier payment terms simplifies the debt repayment process and saves money.

- Automate Payments

Set up automatic payments so you won’t miss due dates again. Late payments result in penalty charges and damage to your credit score.

Avoid These Common Debt Repayment Mistakes

- Skipping Your Minimum Payments – If you fail to make minimum payments, you may face delayed charges, increased interest rates, and damaged credit.

- Assuming New Debt – Do not add new debt during the payoff of other debts. This is a vicious circle from which people usually can’t break free.

- Not Changing Spending Habits – To pay off debt, you need to cut some discretionary spending. Do not buy luxuries until your debt is under control; just necessities.

The Psychological Benefits of Debt Repayment

Beyond financial advantages, paying off debt offers profound emotional and mental benefits:

- Reduced stress: Eliminating debt alleviates financial anxiety.

- Increased confidence: Gaining control over your finances boosts self-esteem.

- Freedom to save and invest: Once debt-free, you can focus on building wealth and working towards financial goals.

Conclusion

Deciding what to pay off first is a tough decision. Whether you go for the snowball or avalanche method or even both, the plan is to stay consistent and motivated. High-risk debts will be first, a budget will be implemented, and one should avoid common pitfalls, and more than likely, financial freedom will be yours.

Start today and remember: every payment brings you closer to that debt-free future!